Earning Points Can Be Easy

The most common thing I hear about collecting miles & points is that it’s too complicated, too time consuming or too confusing. I find so many people that don’t even bother to start collecting simply because it’s intimidating, and they don’t know where to start. I’m here to fix that!

Here is my SIMPLE strategy for collecting points that anyone can do. If you don’t know how to get started, don’t want to mess with a lot of cards or are a little overwhelmed with all the options, then this strategy is for you!

Before we get started, please take a moment to think about how you use credit. Do you tend to carry a balance on your credit cards or maybe have less than stellar credit? If so, then this strategy is NOT for you. It is so important to pay off your credit card bill every month in full. If you carry a balance, you will negate all the benefits of the points you are collecting, on top of paying heavy interest fees. For more information, check out Miles and Points 101- Part 1

Easiest Points Earning Strategy Ever

It’s no secret that Chase Ultimate Rewards Points are my favorite overall type of points out there. They are easy to earn and easy to use.

Step 1

Apply for a Chase Sapphire Preferred card with 50,000 point bonus. With this card you will earn 2x points on dining and travel and 1x points on everything else. You will receive a 50,000 point bonus after spending $4,000 on the card in the first 3 months. The $95 annual fee is waived the first year. This card will also give you some solid travel insurance and purchase protection and no foreign transaction fees.

Step 2

Apply for the Freedom Unlimited Card. This card is advertised as a cash back card, but if you also hold a Sapphire card you can turn this into a points earning card! This card comes with a 15,000 point bonus (advertised as $150 cash back) after $500 in purchases the first 3 months and earns 1.5x points on every purchase! Best of all, it has no annual fee. After you earn points on this card, you can easily transfer them to your Sapphire card and then use them towards travel!

Step 3

Do your online shopping through the Chase Ultimate Rewards shopping portal. Once you are in your online account you can access your Ultimate Rewards Shopping Portal. Just click on Earn Points>Shop Through Chase to access the shopping portal. After that, it works just like Ebates. Just click through the portal to make a purchase and you will receive bonus points.

Step 4

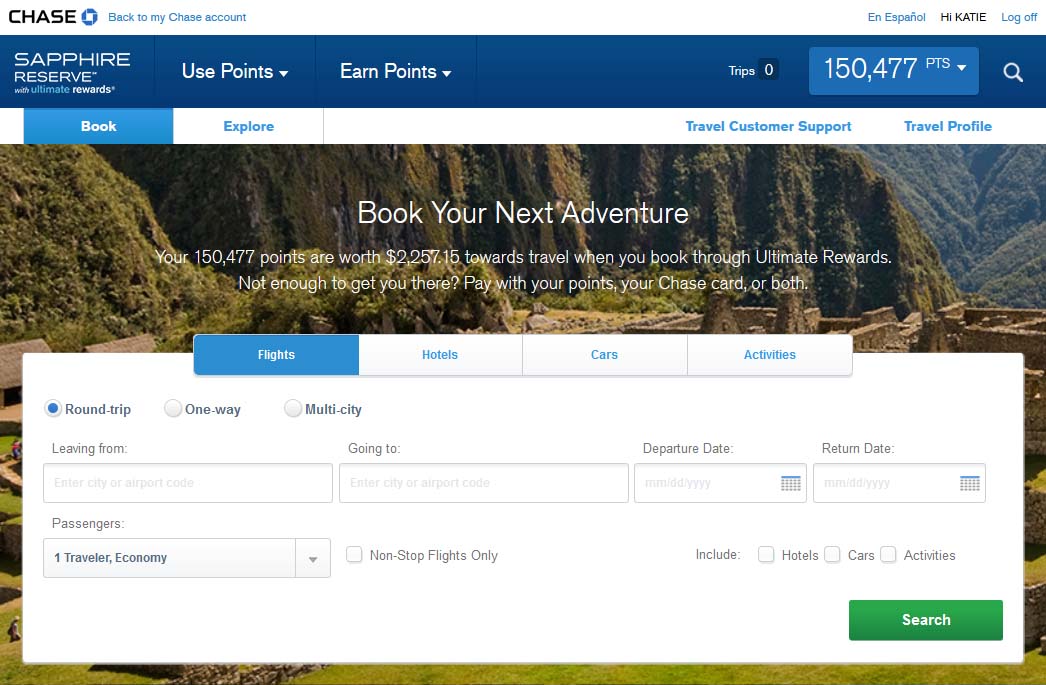

Now comes the fun part – using your points! You can use Chase Ultimate Rewards points in 2 ways – through their travel portal or by transferring them to hotel and airline partners. When redeemed through the Chase portal, your points are worth 1.25 cents per point. They have a simple interface that lets you search and book travel as you would on any other site.

Or you can transfer your points to any one of Chase’s transfer partners. This turns them into airline miles or hotel points. Most of the time you will get a better point value by transferring your points out of the Ultimate Rewards program.

So, there you have it! A super simple strategy to earn valuable points without all the hassle. Here’s a quick review:

- Get the Chase Sapphire Preferred Card with 50,000 point bonus. Use this card for all of your Travel and Dining Purchases

- Get a Freedom Unlimited Card with 15,000 point bonus (advertised as $150 cash back). Use this card for All Other Purchases

- Do all of your online shopping through the Chase Shopping Portal

- Use your points through the Chase Travel Portal for a value of 1.25 cents per point or transfer to a travel partner

By now you can see that you don’t need a ton of cards or a huge plan to get some great value out of travel hacking. For some other good beginner tips check out Travel Hacking: Beginner’s Insight from fellow blogger, The Wanderlust Dietitian. Happy Travels!

LOVE IT? PIN IT!

Four points which make credit card hacking easy.

1. Put all CC on auto pay.

2. Put all CC on spreadsheet.

3. Put all CC and award programs in award wallet.

Sign up now for $10/ yr before increase to $30/yr.

4. Spend a little on all CC to push out expiration dates of pts.

All good points, SteveO! I personally don’t use award wallet because I’m a bit of a control freak, but I know it’s valuable to many.

He should be fine getting his own Chase Sapphire Preferred for the additional 50,000. Your credit cards and car loans won’t count towards 5/24 for your husband – just the accounts he has opened in the last 2 years. He can also add you as an authorized user on his account for another 5,000 points. Then you can both get the Freedom Unlimited too. The bonus is 15,000 but there are reports, my brother included, that the bonus is 30,000 if you sign up in branch for the Freedom Unlimited – so it might be worth a quick trip to a Chase branch. Let me know what you end up doing. Australia will be a great trip!

Hey Katie!

I have the Chase Sapphire Preferred and also go the bonus miles by adding my husband to the account. We have 130,000 miles, but need about 200,000 to xfer to an airline partner and get us to Australia.

Can I have him apply for his own Chase Sapphire Preferred account for the additional 50,000? (I know points can be transferred to someone else in the household.) He says that he has only applied for two other cards this past year and he thinks the past 2 years, so we should be good with the 5/24 rule. However, will they include my credit card applications and our auto loans to include in the 5/24 rule? (It was less than 24 months ago that I got the Sapphire Preferred card and I opened up an Amazon card, too. Within 24 months, I applied for 2 car loans. (One for my original vehicle and one for my replacement vehicle.)

Or is that too complicated and should I just wait a bit before having him apply? Wanted to check before I apply for the Chase Freedom Unlimited!