How do you know what the best credit cards for Southwest points are?

You might assume that a Southwest branded credit card would be your best bet, but you’d be wrong. Let me explain.

Southwest credit cards are great for the perks they offer and the generous sign-up bonuses you can earn. However, for everyday spending, you’ll earn more points by using a Chase Ultimate Rewards credit card and then transferring those points to Southwest.

In this post, I’ll show you which credit cards you need to be able to transfer your points, when it makes sense to have a Southwest credit card, and I’ll show you an insider trick to expand your options even more.

Legal Stuff: This post may contain affiliate links and/or credit card referral links. Also, we are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.

Earn Southwest Points Through Chase Credit Cards

Chase Ultimate Rewards points transfer to Southwest Rapid Rewards at a 1:1 ratio. In order to do this, you’ll need to have a premium card that charges an annual fee:

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve Card

- Ink Business Preferred Credit Card

The cool thing is that once you have one of the premium Chase cards, you can turn the cash-back from the no-annual-fee cards into points, which makes them much more valuable.

For example, the new Chase Freedom Flex Credit Card or the Chase Freedom Unlimited Card both earn 3% cash-back at dining and drug store purchases. When you also hold a premium Chase card, you can turn that cash-back into points, essentially making this card earn 3x points at restaurants and drug stores.

Freedom Flex Card

Current Sign-On Bonus: $200 (equal to 20,000 points) after spending $500 in the first 3 months

- 5% cash-back (or 5x points) on quarterly rotating categories (up to $1,500)

- 5% cash-back (or 5x points) on travel purchased through Chase Ultimate Rewards

- 3% cash-back (or 3x points) on dining and drugstore purchases

- 1% cash-back (or 1x point) on all other purchases

This card does not have an annual fee.

Chase Freedom Unlimited Card

Current Sign-On Bonus: $200 (equal to 20,000 points) after spending $500 in the first 3 months

- 5% cash-back (or 5x points) on travel purchased through Chase Ultimate Rewards

- 3% cash-back (or 3x points) on dining and drugstore purchases

- 1.5% cash-back (or 1.5x points) on ALL purchases

This card does not have an annual fee.

Chase Sapphire Preferred Card

Current Sign-On Bonus: 60,000 points after spending $4,000 in the first 3 months

- 2x points on travel and dining purchases

- 2x points on grocery store purchases (up to $1,000 per month) through April 30, 2021

- Access to Chase hotel and airline transfer partners

- Travel insurance and protections

The annual fee for this card is $95.

Chase Sapphire Reserve Card

Current Sign-On Bonus: 50,000 points after spending $4,000 in the first 3 months

- 3x points on travel and dining purchases

- 3x points on grocery store purchases (up to $1,000 per month) through April 30, 2021

- $300 annual travel credit

- Global Entry or TSA PreCheck application bonus (up to $100 value)

- Priority Pass membership for airport lounge access

- Access to Chase hotel and airline transfer partners

- 50% more value when you redeem points in the Ultimate Rewards portal

- Travel insurance and protections

The annual fee for this card is $550.

How To Transfer Chase Points To Southwest

Transferring Chase Ultimate Rewards points to Southwest is a quick and easy process. Before you begin, be sure to have both a Chase Ultimate Rewards account and a Southwest Rapid Rewards account set up.

First, transfer any points from your cash-back card (Freedom Flex card or Freedom Unlimited card) to your premium Chase credit card (Chase Sapphire Preferred card, Chase Sapphire Reserve card, or Ink Business Preferred card).

Log into your account, select your cash-back card, and click on Combine Points.

Then you’ll be able to freely transfer points between your cards as well as those of your household members.

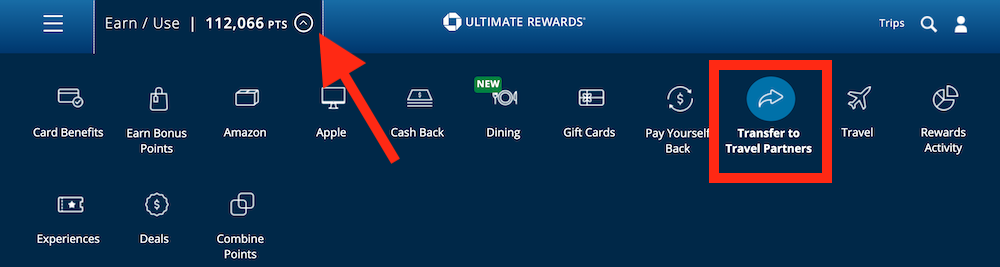

Then, go to your Ultimate Rewards account of your premium credit card, click the drop-down arrow, and select Transfer to Travel Partners.

Scroll down to Southwest Airlines and click Transfer Points. You can then enter the information for your Southwest account and choose how many points you want to transfer. Transfers are usually instant.

Southwest Airlines Credit Cards For Southwest Points

Southwest Airlines also offers co-branded credit cards that can help you earn Southwest Rapid Rewards points. These cards don’t have the great bonus categories offered by Chase cards, but if you need some additional points fast, earning the sign-up bonus on one of these cards is a great option.

Southwest Rapid Rewards credit cards may not be the best for earning points, but they offer lots of benefits and perks that can make them a valuable addition to your wallet. Plus the points earned on Southwest credit cards will count towards the Southwest Companion Pass!

Southwest Rapid Rewards Plus Credit Card

Current Sign-On Bonus: 50,000 points after spending $2,000 in the first 3 months and an additional 30,000 points after spending $10,000 in the first 9 months

- 5x points on Southwest purchases up to $2,000 per month through March 31, 2021 (new applicants only)

- 2x points on Southwest purchases and partner hotel and car rental purchases (current cardholders)

- 3,000 bonus points on cardmember anniversary (~ $45 value)

The annual fee for this card is $69.

Southwest Rapid Rewards Premier Credit Card

Current Sign-On Bonus: 50,000 points after spending $2,000 in the first 3 months and an additional 30,000 points after spending $10,000 in the first 9 months

- 5x points on Southwest purchases up to $2,000 per month through March 31, 2021 (new applicants only)

- 2x points on Southwest purchases and partner hotel and car rental purchases (current cardholders)

- 6,000 bonus points on cardmember anniversary (~ $90 value)

The annual fee for this card is $99.

Southwest Rapid Rewards Priority Credit Card – Best Value

Current Sign-On Bonus: 50,000 points after spending $2,000 in the first 3 months and an additional 30,000 points after spending $10,000 in the first 9 months

- 5x points on Southwest purchases up to $2,000 per month through March 31, 2021 (new applicants only)

- 2x points on Southwest purchases and partner hotel and car rental purchases (current cardholders)

- 7,500 bonus points on cardmember anniversary (~ $112 value)

- $75 annual Southwest travel credit

- 4 upgraded boardings per year

- 20% back on inflight drinks and Wi-Fi

The annual fee for this card is $149.

Best Value Southwest Credit Card: While the Southwest Priority card has the highest annual fee, it offers the best value out of the 3 options. The $75 annual travel credit essentially makes the annual fee $74. Then you’ll get 7,500 bonus points on your anniversary which have about $112 in value. That more than makes up for the annual fee without taking into consideration the value of the upgraded boarding passes and inflight food and WiFi discount.

How Does It Work In Real Life?

So let’s look at an example. Let’s say you spend $2,000 on travel through the Chase portal, $1,000 on dining, $1,000 in non-bonus categories

If you had the Freedom Unlimited card and the Chase Sapphire Reserve combo you would have 14,500 points from all spending.

- 10,000 points from the travel spend on the Freedom Unlimited card (5x points)

- 3,000 points from the dining spending on either card (3x points)

- 1,500 points from non-bonus spending on the Freedom Unlimited card (1.5x points)

If you put all that spend on any of the Southwest cards you would only have 4,000 points.

That’s well over 3 times more points just by using the right credit cards! If you are strictly looking to earn the most points with your everyday spending, a Chase card combo is hard to beat.

Final Thoughts: The Ultimate Credit Card Combo For Southwest Flyers

If you’re a frequent traveler and love flying on Southwest Airlines (like me) here is the ultimate combination of credit cards so you’ll get maximum benefits. This combo is one that I personally have in my wallet.

- Chase Sapphire Reserve card: For amazing travel benefits, protections, and 3x points on travel and dining

- Freedom Flex card: For fantastic rotating bonus categories

- Freedom Unlimited card: For easy earning on every single purchase

- Southwest Priority card: For the annual Southwest travel credit and bonus points, plus upgraded boardings

Featured Image Credit: ThreeMilesPerHour/Pixabay

![A Family Vacation on Grand Cayman [Activities, Scuba, and Resorts]](https://www.zenlifeandtravel.com/wp-content/uploads/2022/04/Seven-Mile-Beach-in-Grand-Cayman-200x150.jpg)