With so many travel and rewards credit cards out there, it can get confusing at times. But, it’s your lucky day! I am here to break it down for you and tell you what you need to know to get the most out of your credit card. Today I will go over the differences between the Chase Freedom vs Freedom Unlimited cards and help you determine which one is right for you.

The Chase Freedom and Chase Freedom Unlimited are considered different products even though their names are similar. However, they are both no annual fee cards that offer cash back on your purchases.

Since these cards are considered different products, you can apply for BOTH of them and receive the new cardmember bonus on each card so long as you do not currently have the card or received a bonus in the last 24 months.

Chase Freedom

- No Annual Fee

- $150 Cash Back Bonus once you spend $500 in the first 3 months of having the card (*see below to learn how to turn this into 15,000 Chase Ultimate Rewards Points!)

- $25 cash back bonus after you add an authorized user who makes a purchase in the same first 3 months

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter (bonus categories rotate throughout the year). This must be activated each quarter.

- 1% cash back on all other purchases

Chase Freedom Unlimited

- No Annual Fee

- $150 Cash Back Bonus once you spend $500 in the first 3 months of having the card (*see below to learn how to turn this into 15,000 Chase Ultimate Rewards Points!)

- $25 cash back bonus after you add an authorized user who makes a purchase in the same first 3 months

- 1.5% cash back on all purchases

If you are only going to get one of these cards, choose the Freedom Unlimited. You will earn a flat 1.5% cash back (or 1.5 points per dollar) on every purchase you make. However, since these are no annual fee cards, it can’t hurt to have both in your wallet. You can max out the bonus category on the Freedom while putting all other purchases on the Freedom Unlimited.

What’s Better – Cash Back or Chase Ultimate Rewards Points?

These cards are great to have in your wallet since they don’t have an annual fee. However the real magic happens when you pair one or both of these cards with a premium Chase card like a Chase Sapphire or Chase Ink. Then you can transfer the cash back you earn on these cards into points which can then be transferred to airline miles or hotel points. This can make them significantly more valuable.

As cash back, each point is worth 1 cent. That means the $150 cash back bonus on either of these cards is worth 15,000 Ultimate Rewards points. 15,000 Ultimate Rewards points can be much more valuable than $150. For example, you could transfer those 15,000 points to Hyatt to book a room for 1 night at the Hyatt Centric French Quarter New Orleans. I found availability next month for $359 per night. That means you would be getting 2.4 cents per point value ($359 divided by 15,000 points) instead of the 1 cent per point you would get if you took the cash back.

Link: Chase Ultimate Rewards Overview

How To Transfer Freedom Points Into Chase Ultimate Rewards Points

STEP 1: Go to the Ultimate Rewards section of your online account. When you have more than 1 Chase card, you will see them listed here. Choose the card you would like to view.

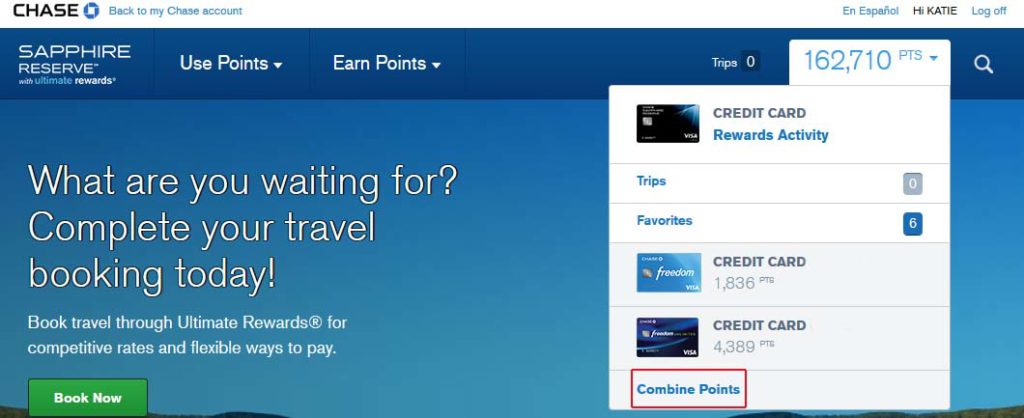

STEP 2: In the upper right hand corner of your screen you will see a box with the point total for your selected card. Hover over that and you will get a drop down box. In that box at the bottom click on “Combine Points”

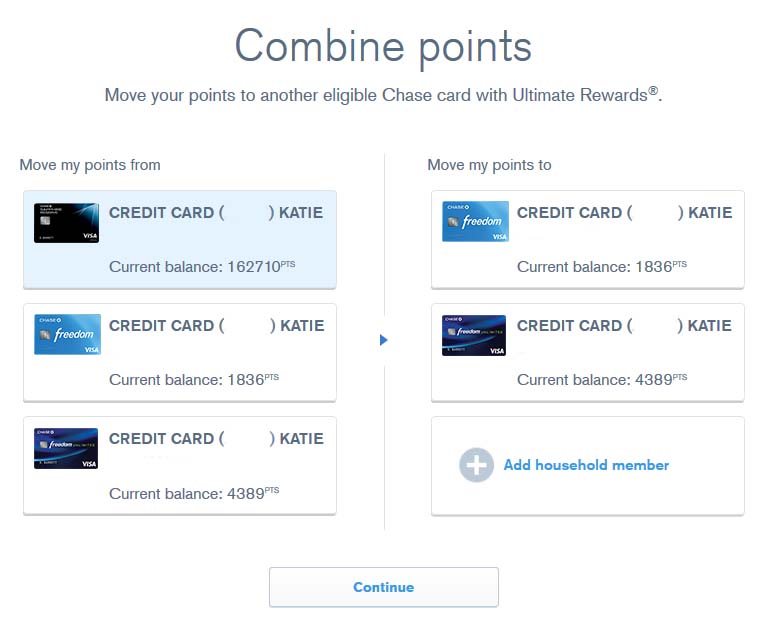

STEP 3: Once you click on “Combine Points” you will be able to select the accounts you want to transfer your points to and from. You can also add the account of another member of your household.

STEP 4: Once you have chosen the accounts you want to transfer your points to and from you will be able to select the amount of points to transfer. Hit “Review” to review your choices and complete the transfer.

STEP 5: Be sure to hit “Confirm & Submit to complete the point transfer.

Chase Ultimate Rewards Points

Chase Ultimate Rewards Points are my favorite points currency. They are easy to earn and can be transferred to 7 different airlines and 4 hotel partners including Southwest, United, Hyatt, and Marriott. This makes them extremely flexible and very easy to use.

If you are new to the Points and Miles game, start with Chase points or another transferable currency like American Express Membership Rewards Points. Then, check out my Beginner’s Guide and you will be on your way to earning free trips (like my weekend trip to Scottsdale, AZ) in no time!

Happy Travels!

LOVE IT? PIN IT!

Hi,

I’m new to travel hacking and credit cards. I want to get both the chase Safire reserve and the freedom unlimited. What is the best way to go about doing that to get the bonus without applying for them both at the same time? I want to keep the freedom but I will probably cancel the Safire once I redeem the points. If I get the freedom and get the bonus can I immediately apply for the Safire and get the bonus or do I have to wait some time?

As long as you haven’t opened 5 or more credit cards in the previous 24 months, you should be ok getting both of those. Yes, you can get the Sapphire right after you earn the bonus on the Freedom.